In a RIVET-backed futures contract, the traded volatility strike is converted to a futures price and the notional vega of the trade is converted to variance futures. During this

conversion process, a pricing adjustment is made to correct for the differing economics created by differences in collateral flow and margin payments. Also, both the traded volatility

strike and notional vega are adjusted for the realized variance from the contract’s inception date until the trade day. Once converted, the result is a standardized, spot starting,

variance future that replicates the payoff streams from different OTC swap transactions.

| OTC Variance Swap | RIVET™ Backed Future | |

|

Price negotiated in

|

Volatility | Volatility |

|

Size negotiated in

|

Vega | Vega |

|

Start convention

|

Spot Starting | Spot Starting |

|

End convention

|

Option Expiration date | Option Expiration date |

|

Price of Instrument

|

Present Value of Swap | Futures Price* -- Present Value of Swap w/ standard strike |

*adjusted for return on variation margin

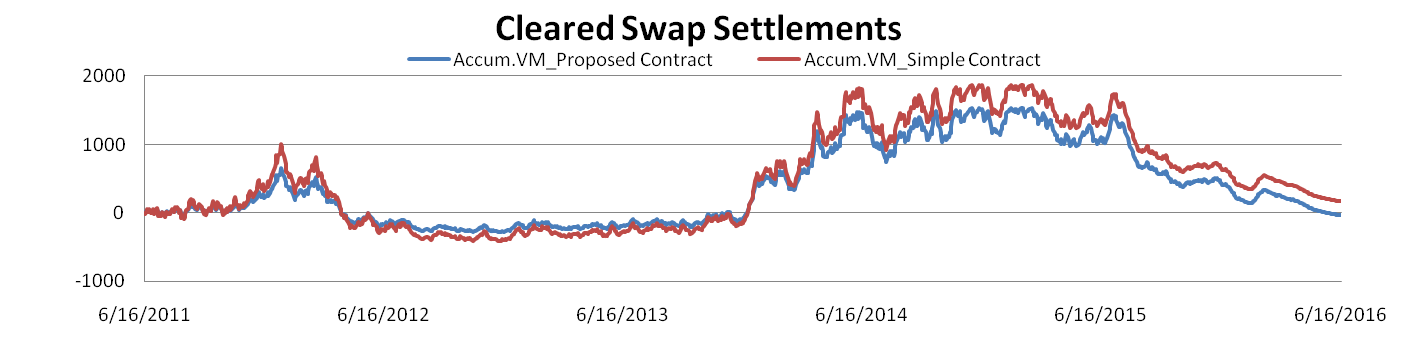

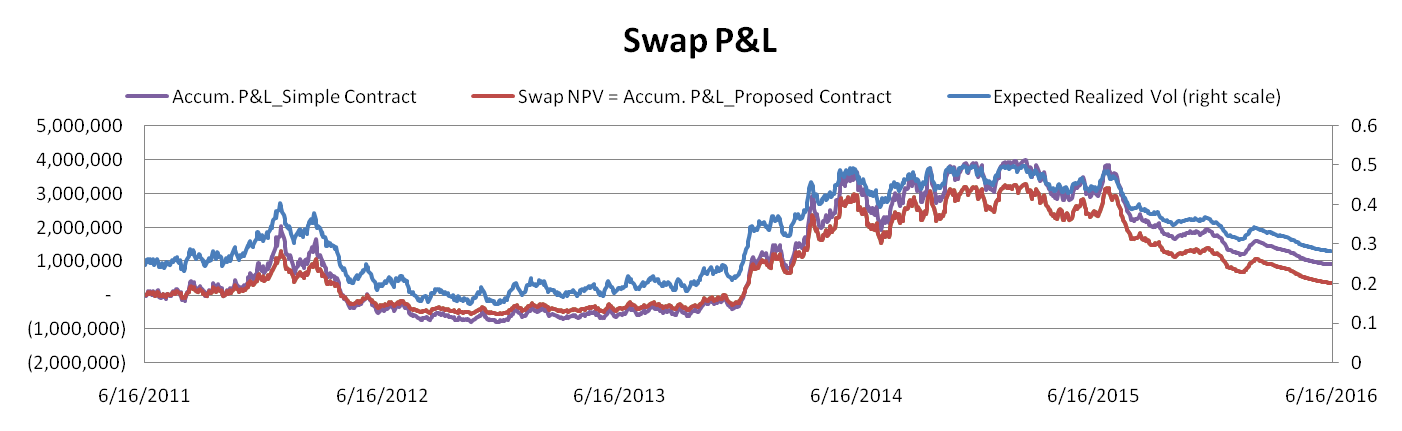

5-Year Variance Swap (Simulation)